Chapter 15, Multiple Deposit Creation and the Money Supply Process Video Solutions, The Economics of Money, Banking, and Financial Markets | Numerade

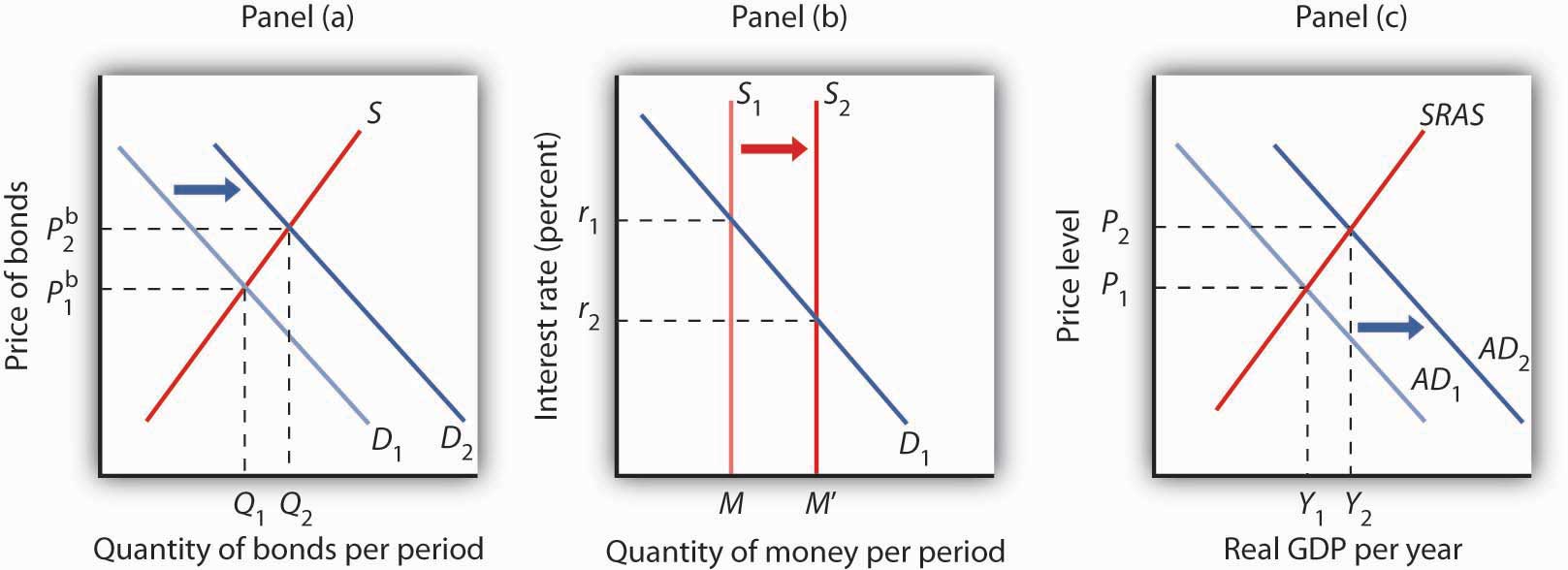

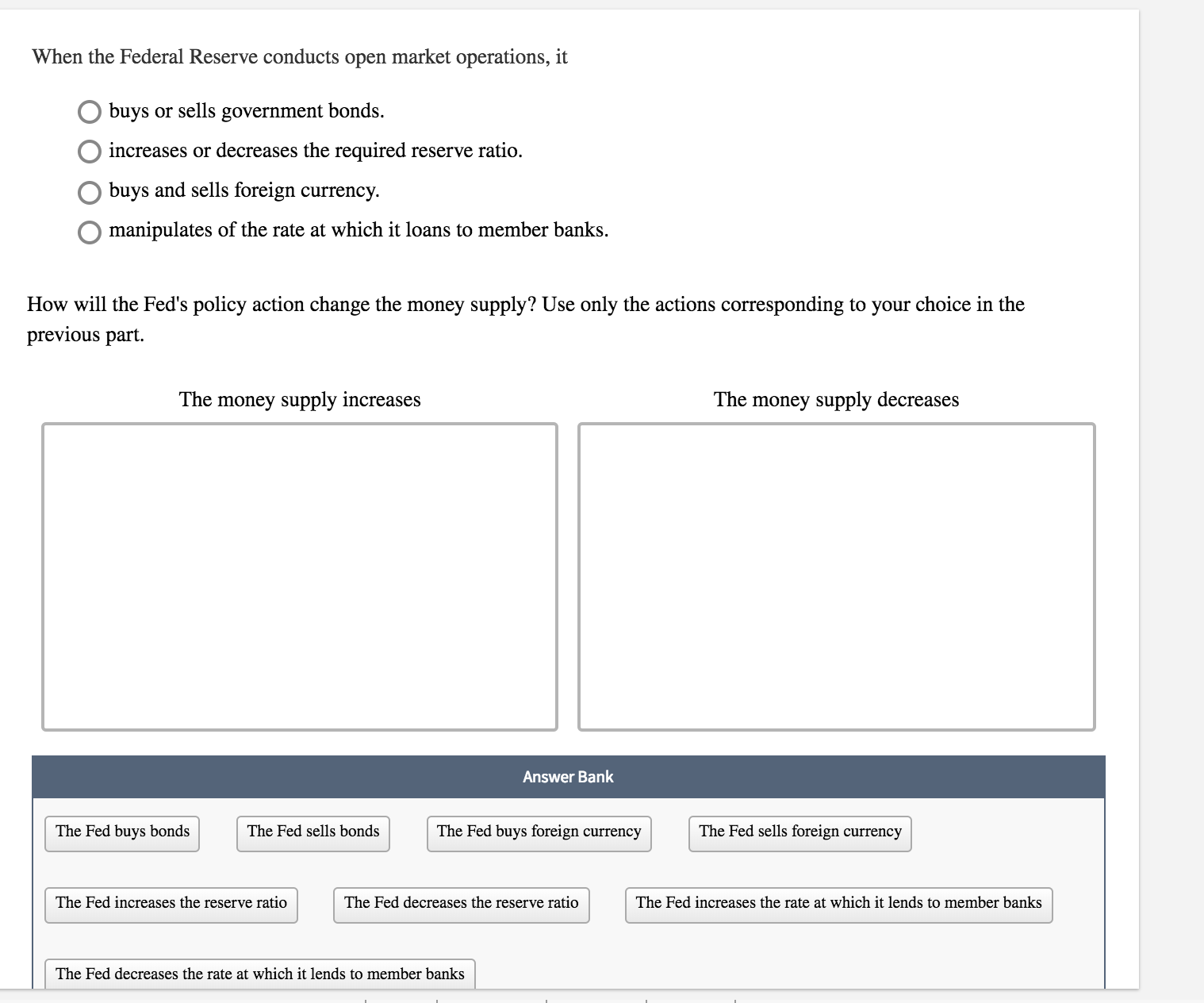

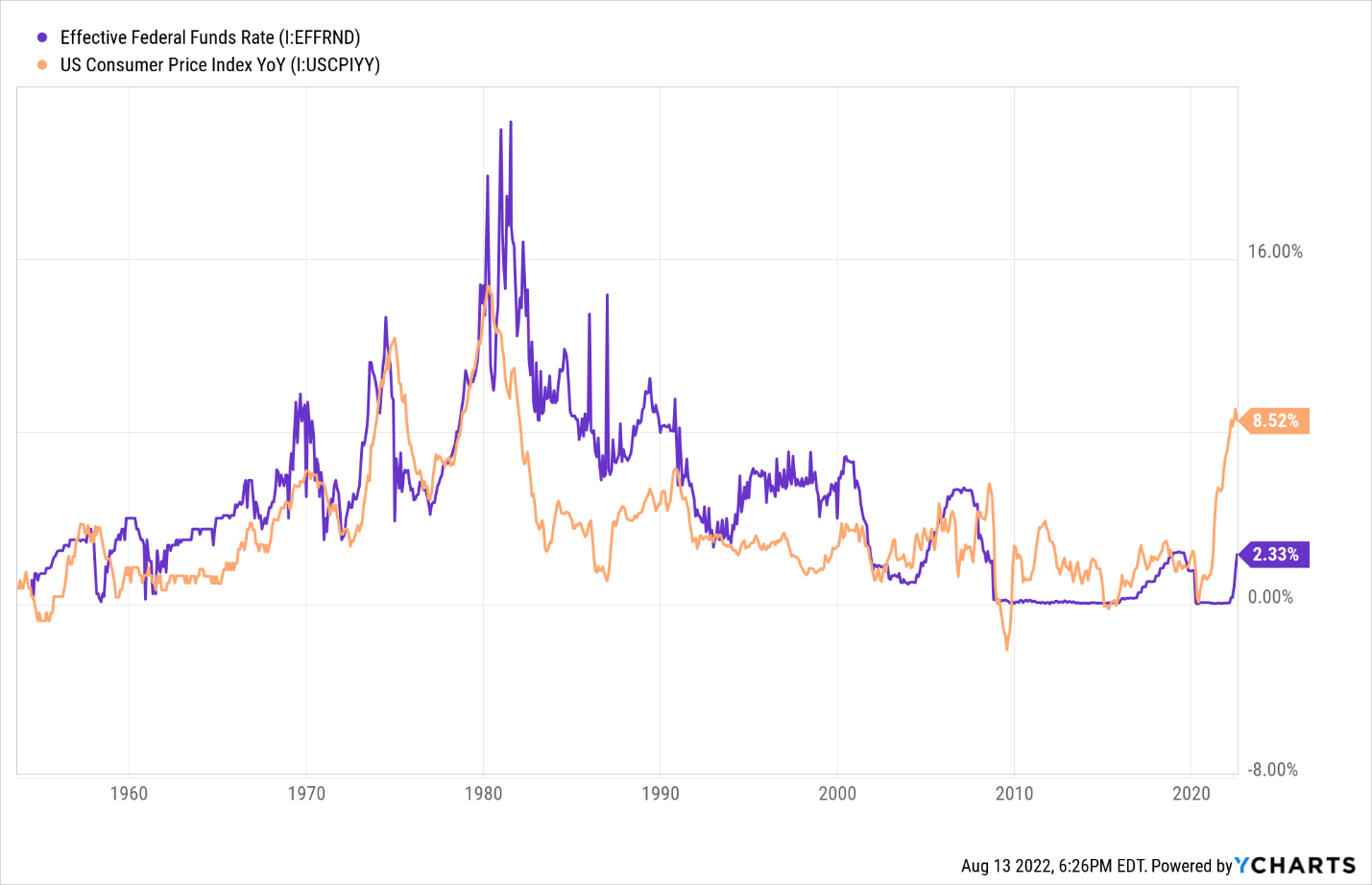

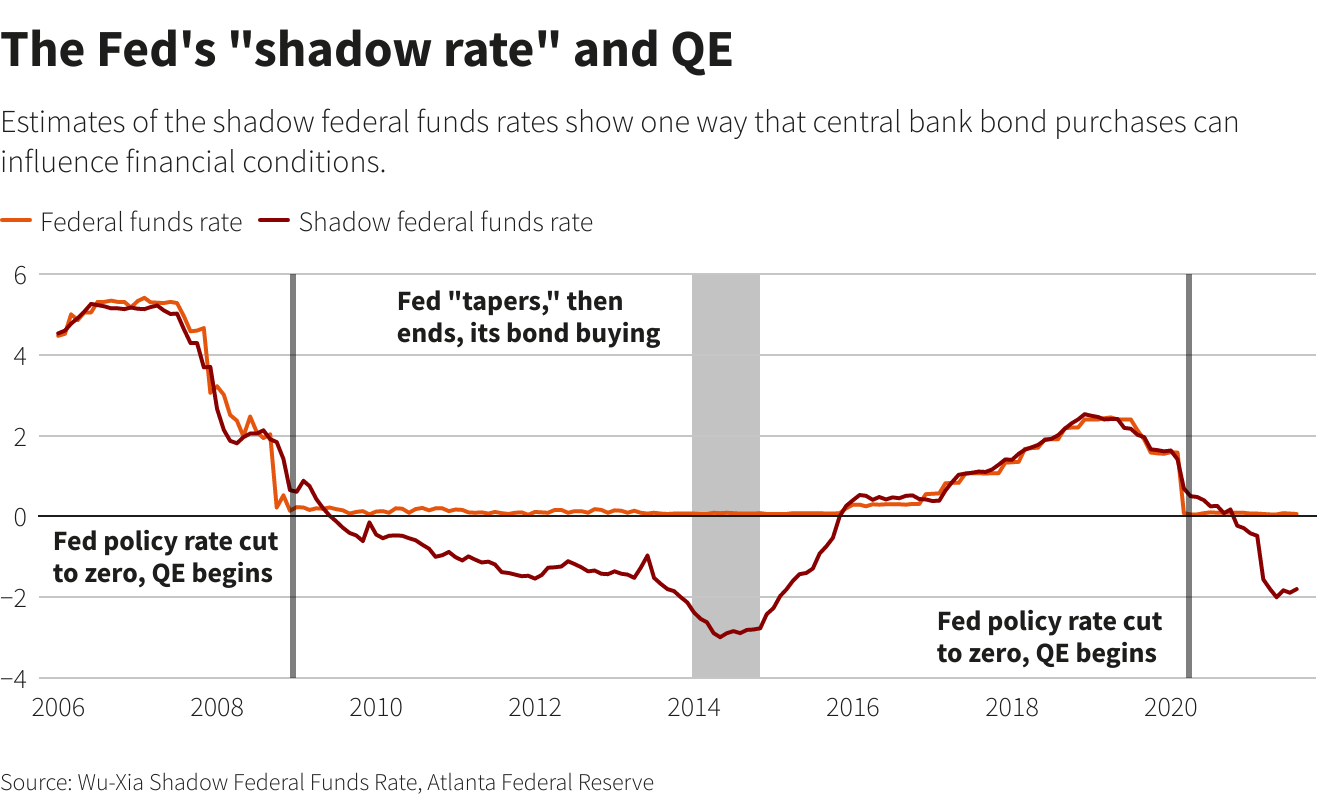

Suppose current market federal funds rate is 0 percent. Explain how the Fed can increase interest rates without reducing the amount of reserves. Using a diagram. | Homework.Study.com

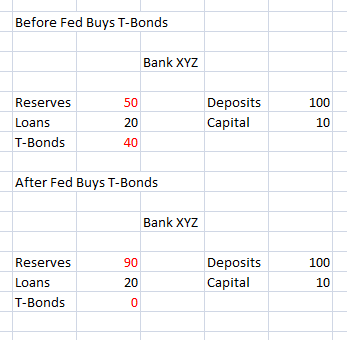

When conducting an open-market sale, the Fed i sells government bonds, and in so doing increases - YouTube

:max_bytes(150000):strip_icc()/Open-Market-Operations-OMO-Final-ec375b8eb4d44b4d80b7bb24c6f1c9f2.jpg)